virginia estate tax exemption

When the gross estate of a decedent at the date of death is of such value as to require filing a federal estate tax return and such estate contains certain farm or business real property which qualified for valuation under 2032A of the Internal Revenue Code and such property has been valued in the manner provided in 2032A for the tax imposed under this. Removal by local governing body 581-36051.

Virginia Granted Data Centers 124 5m In Tax Breaks Last Year Dcd

The Virginia Homestead Exemption Amount.

. Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. There is a federal estate tax and many states levy their own estate taxes. Be 65 or older.

Property becomes taxable immediately upon sale by tax-exempt owner 581-3602 Exemptions not applicable to associations etc paying death etc benefits 581-3603 Exemptions not applicable when building is source of revenue 581-3604 Tax exemption information 581-3605 Triennial application for exemption. The federal estate tax exemption is 5450000 for decedents dying in 2016. The exemption doesnt apply to property purchased by the Commonwealth of Virginia then transferred to a private.

The tax does not apply to the following types of property within an estate. Property passing by the exercise of a power of appointment. Jointly held property with right of survivorship.

To DVS at infodvsvirginiagov with any questions or in search of advice or clarifications regarding the real property tax exemption. The federal estate tax exemption is 1170 million for 2021 and will increase to 1206 million for deaths in 2022. The exemption is portable meaning that one spouse can pass their exemption to the other.

Property owned by the Commonwealth of Virginia Parks or playgrounds for the use of the general public Property owned by churches or religious bodies Nonprofit private or public cemeteries or burying grounds Property owned by public or law. Department of Veterans Affairs or its successor agency pursuant to federal law to have a 100 service connected permanent and total disability and who occupies the real property as his or her. Though there isnt an estate tax in Virginia you might have to pay the federal estate tax.

The following property is exempt from taxation in Virginia. Property owned directly or indirectly by the Commonwealth or any political subdivision thereof. Sincerely John Maxwell Commissioner johnmaxwelldvsvirginiagov 804-786-0220 DVS Headquarters Address.

Federal Estate Tax. The exemption is portable for spouses meaning that with the right legal steps a couple can protect 2406 million after both spouses have died. While other local jurisdictions have an exemption that is lower Virginia does not.

Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from taxation the real property including the joint real property of married individuals of any. Killed in Action Surviving Spouse Affidavit - Real Estate Tax Exemption. The top tax rate for the federal estate tax.

Recent History For Virginians who died prior to mid-2007 Virginias state estate. Estate taxes sometimes called death taxes are wealth taxes imposed by Congress and state legislatures on the property owned by a deceased person at the time of his death. Pursuant to subsection 6 a6 of Article X of the Constitution of Virginia on and after January 1 2003 any county city or town may by designation or classification exempt from real or personal property taxes or both by ordinance adopted by the local governing body the real or personal property or both owned by a nonprofit organization including a single member.

The exemption applies to real property which includes your home or condominium and personal property used as a residence so your mobile home would also be. Exemption from taxes on property for disabled veterans. Department of Veterans Affairs or its successor agency pursuant to.

14th thSt 17 Floor Richmond VA 23219. ST-12 unless the purchase was. You are not eligible for this tax exemption if you have remarried.

The Commonwealth of Virginia exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the U. Pursuant to the authority granted in Article X Section 6 a6 of the Constitution of Virginia to exempt property from taxation by classification the following classes of real and personal property shall be exempt from taxation. Senior and Disabled Real Estate Tax Relief.

The federal estate tax exemption is 1170 million in 2021 and goes up to 1206 million in 2022. Property Exempt by State Law. The Code of Virginia Title 581 Chapter 36 outlines property.

Be totally or permanently disabled. Commissioner of the Revenue Taxpayer Assistance. 2 days agoOpponents of the Florida legislatures move to dissolve Disneys self-governed tax district say local taxpayers will be saddled with hefty debt and increased property tax payments but proponents.

Government Purchases Things sold to federal or state governments or their political subdivisions are not subject to sales tax. Important Information Regarding Property Tax Relief for Seniors in Virginia. There are certain requirements they must meet to qualify for the tax relief programs.

No tax is imposed on estates valued at 15000 or less. West Virginia wont tax your estate but the federal government may if your estate has sufficient assets. Insurance proceeds payable to a named beneficiary other than the estate.

Virginia Department of Veterans Services 101 N. A similar exemption was unnecessary for other types of remainder interests because such interests are not generally subject to the federal estate tax and. Virginia currently does not have an independent estate tax that is lower than the federal exemption.

Under the Virginia exemption system homeowners can exempt up to 25000 of equity in a home or other property covered by the homestead exemption. This exemption was designed to prevent both the Virginia estate tax and the postponed inheritance tax from being imposed on remainder interests that were coupled with a general power of appointment. If you are a surviving spouse of a First Responder who has been killed in the Line of Duty your principal residence may be eligible for an exemption of your real estate taxes on your home and up to one acre in Virginia.

Senior citizens and totally disabled persons have the right to apply for an exemption deferral or reduction of property taxes in Virginia.

Legacy Assurance Plan Avoid Probate Probate Personal Injury Estate Planning Checklist

Selling Inherited Property In Virginia 2022 How To Guide

The 10 Happiest States In America States In America Wyoming America

Virginia Retirement Tax Friendliness Smartasset

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Virginia Non Resident Tax For Expats A Guide For Expats

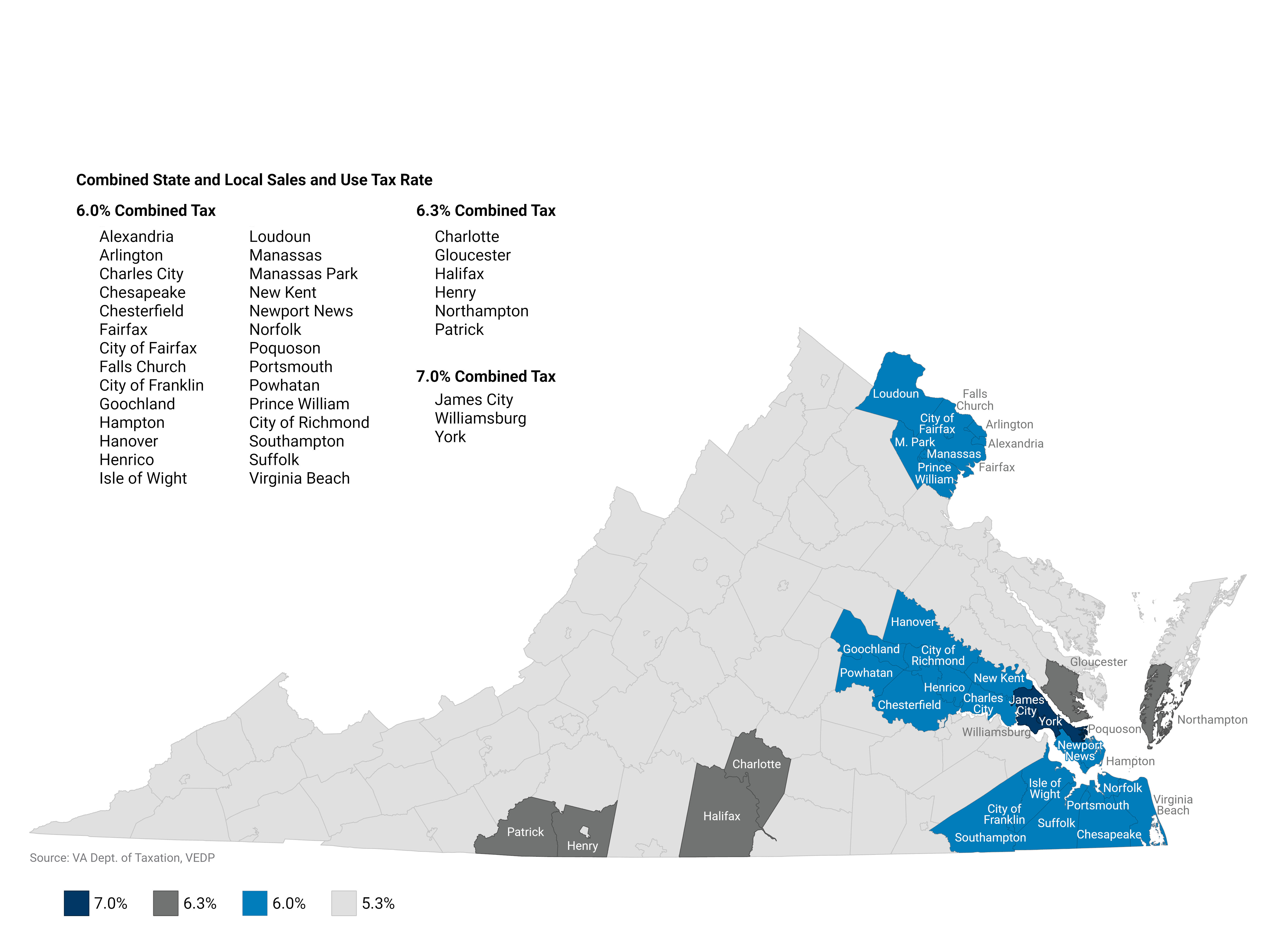

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Virginia State Taxes 2022 Tax Season Forbes Advisor

What Is A Trust Estate Planning Fidelity Estate Planning How To Plan Estate Planning Attorney

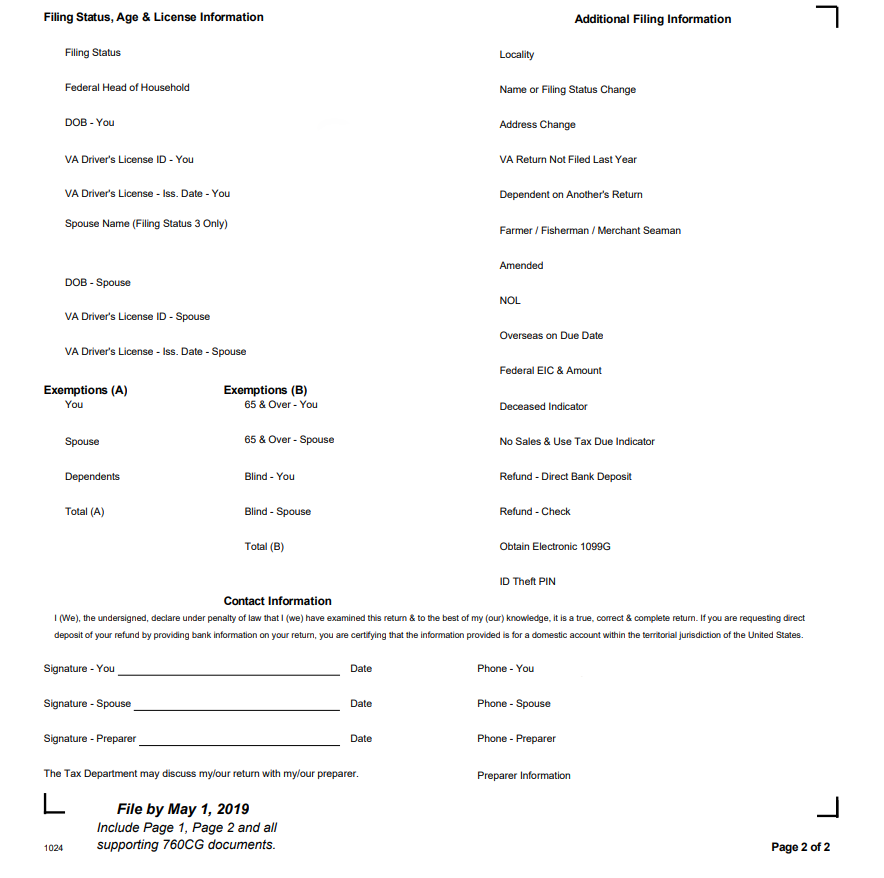

Instructions On How To Prepare Your Virginia Tax Return Amendment

Population Wealth And Property Taxes The Impact On School Funding

How To Reduce Virginia Income Tax

How To Reduce Virginia Income Tax

Filing Virginia State Tax What To Know Credit Karma

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

How To Reduce Virginia Income Tax

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms West Virginia Tax

Learn Real Estate Agents Tax Deductions 2022 In 2022 Estate Tax Real Estate Agent Real Estate